A reset is in store for Canada’s housing market in 2026

Stable prices and improved affordability expected to continue coaxing buyers off the sidelines next year

By: Royal LePage

TORONTO, December 9, 2025

After a year defined by economic uncertainty and shifts in government on both sides of the border, 2026 is shaping up to be a true reset for the Canadian real estate market. Increased supply, lower borrowing costs and easing competition are expected to gradually bring more buyers back to the offer table in the year ahead.

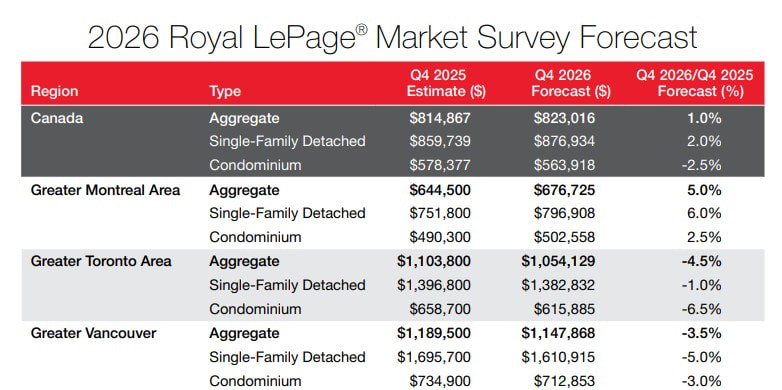

The aggregate1 price of a home in Canada is set to remain relatively flat, increasing a modest 1.0% year over year to $823,016 in the fourth quarter of 2026. The median price of a single-family detached property is expected to increase 2.0% to $876,934, while the median price of a condominium is anticipated to decrease 2.5% to $563,918.2

“Solid market fundamentals – including lower interest rates, increased supply, and reduced competition – have created a more favourable environment for consumers,” said Phil Soper, president and chief executive officer, Royal LePage. “First-time buyers and those searching in the country’s most expensive regions have a rare window to act on their home ownership plans at reduced prices. While we don’t expect a sharp rebound, this improved affordability will rebuild market confidence among both buyers and sellers, setting the stage for more sustainable, albeit modest, price growth in 2026.”

Home prices are expected to rise in major markets across the country in 2026, with the exception of Canada’s two most expensive cities. The aggregate price of a home in the Greater Toronto Area and Greater Vancouver is forecast to decrease 4.5 per cent and 3.5 per cent year over year in the fourth quarter of 2026, respectively. During the same period, the aggregate price of a home in the Greater Montreal Area is expected to rise 5.0 per cent. For the second consecutive year, Quebec City is forecast to see the greatest gains among all major regions, with an anticipated increase in the aggregate home price of 12.0 per cent. Regina, which continues to see robust demand and constrained supply, is anticipating a 4.0 per cent increase in home prices over the same period. Meanwhile, Ottawa, Calgary, Edmonton, Halifax and Winnipeg are expected to see prices rise no more than two per cent in 2026.

“2025 forced us to recalibrate. Indications are that Canadians are now increasingly adapting to the noise from Washington and confidence at home is holding firm. We saw steady, incremental growth in sales activity in the back half of the year – a clear sign that those who put major decisions on hold are ready to move forward in 2026,” said Soper.

Read full article HERE

REGIONAL SUMMARIES

Greater Toronto Area

In the Greater Toronto Area, the aggregate price of a home in the fourth quarter of 2026 is forecast to decrease 4.5 per cent year over year to $1,054,129. During the same period, the median price of a single-family detached property is expected to decrease a modest 1.0 per cent to $1,382,832, while the median price of a condominium is forecast to decline 6.5 per cent to $615,885.

“Our fall market was more of a whisper than a roar. In a typical cycle, this would be one of the busiest times of the year to buy and sell, but that hasn’t materialized. It’s not simply that buyers are trying to time the best deal. Economic uncertainty is keeping many on the sidelines, particularly concerns around job security and ongoing tariff discussions. With no real urgency to make a move, buyers are taking their time, weighing their decisions and moving with far more caution than we saw just a few years ago when competition was intense and choices had to be made quickly,” said Shawn Zigelstein, broker and leader of Team Zold, Royal LePage Your Community Realty. “Another factor shaping buyer hesitation is the potential shift back to in-office work. With more employers signaling a return to brick-and-mortar workplaces five days a week, many Canadians are unsure what their future commute will look like, making it harder to decide where to put down roots.

“The good news for consumers is that softer competition is creating meaningful opportunities, especially as prices continue to ease. We have seen a year-over-year increase in transactions for freehold properties under $1 million, which tells us that some buyers are capitalizing on current market conditions.”

Zigelstein noted that the slowdown in the new construction segment is likely to continue for now. Builders have paused the launch of new projects and scaled back their marketing efforts. To move existing inventory, some developers are offering incentives such as price reductions or more flexible closing timelines.

“I expect market activity to remain fairly flat throughout the winter, with any material shift unlikely to emerge before the spring. Even with several interest rate cuts already behind us, we haven’t seen a noticeable boost in buyer engagement, which tells us the slowdown is being driven by factors beyond borrowing costs alone,” said Zigelstein. “If we do see a rebound, it’s unlikely to happen overnight. A recovery will probably build gradually as confidence improves, economic signals stabilize, and buyers begin to feel more secure in making long-term decisions.”

Read more HERE

Royal LePage Forecast Chart: rlp.ca/market-forecast-2026

Bank of Canada winds down rate cutting cycle

In 2025, the Bank of Canada reduced its target for the overnight lending rate four times, bringing the key rate down to its current level of 2.25 per cent. After an 18-month rate-cutting cycle that followed two-decade-high interest rates, the Bank has now shifted its focus to supporting a cooling economy while keeping inflation on a sustainable path. Economists widely expect the Bank will only make further cuts if the economy shows major signs of weakness as Canada continues to navigate trade tensions with the United States.

“Mortgage rates are no longer the villain in this story. Borrowing costs have stabilized at a level that supports healthy market activity. Buyers can move forward without worrying they are missing out on cheaper money tomorrow. That clarity alone will unlock demand,” concluded Soper.

According to a recent Royal LePage survey, conducted by Burson, 28 per cent of Canadians who currently rent say that, before signing or renewing their current lease, they considered buying a property rather than renting.[3] When asked what factors influenced their decision to rent instead, 40 per cent of respondents said they were waiting for property prices to decline, and 29 per cent were waiting for interest rates to decrease further. Respondents could select more than one answer.

Read full article HERE

New government initiatives could help housing market move ahead

“2026 sees key market fundamentals pointed in the right direction. Recent polls indicate Canadians are satisfied with our political leadership, opening the door for much-needed progress on housing policy,” said Soper. “The 2025 federal budget laid important groundwork – from funding commitments into Build Canada Homes (BCH) to major infrastructure projects – but the real test will be how effectively those measures are executed in the year ahead. If Ottawa follows through, 2026 could be the year we start to see long-promised initiatives turn into real progress for the Canadian real estate industry.”

Introduced in September, BCH is a new government agency responsible for developing, financing and managing affordable housing projects. As part of its first initiative, six public land sites under the Canada Lands Company portfolio have been earmarked to deliver 4,000 factory-built homes.

“2026 will be a transition year for Canada’s housing market, as improved affordability and less competitive conditions continue to favour buyers. We expect activity to build slowly over the next several months, and if the spring market coincides with steadier economic and trade conditions, buyer confidence could strengthen in tandem.

“Canada’s housing market is moving forward again,” Soper concluded. “Improved conditions are drawing buyers back, step by step. The reset is behind us – now we build.

Read full article HERE

Read Royal LePage’s 2026 Market Survey Forecast for national and regional insights:

- Royal LePage® is forecasting the aggregate price of a home in Canada will increase 1.0% year over year in the fourth quarter of 2026.

- Nationally, single-family detached prices are forecast to increase 2.0% year over year in Q4 of 2026, while condominiums are projected to decline 2.5% over the same period.

- The aggregate home price in the greater regions of Toronto and Vancouver is expected to decrease 4.5% and 3.5%, respectively, while prices in the Greater Montreal Area are forecast to rise 5.0%.

- Quebec City is once again forecast to see the highest gains among all major regions in 2026, with the aggregate home price expected to rise 12.0%.

- Regina, which continues to see robust demand and constrained supply, is anticipating a 4.0% increase in home prices over the same period. Meanwhile, Ottawa, Calgary, Edmonton, Halifax and Winnipeg are expected to see prices rise no more than 2% in 2026.