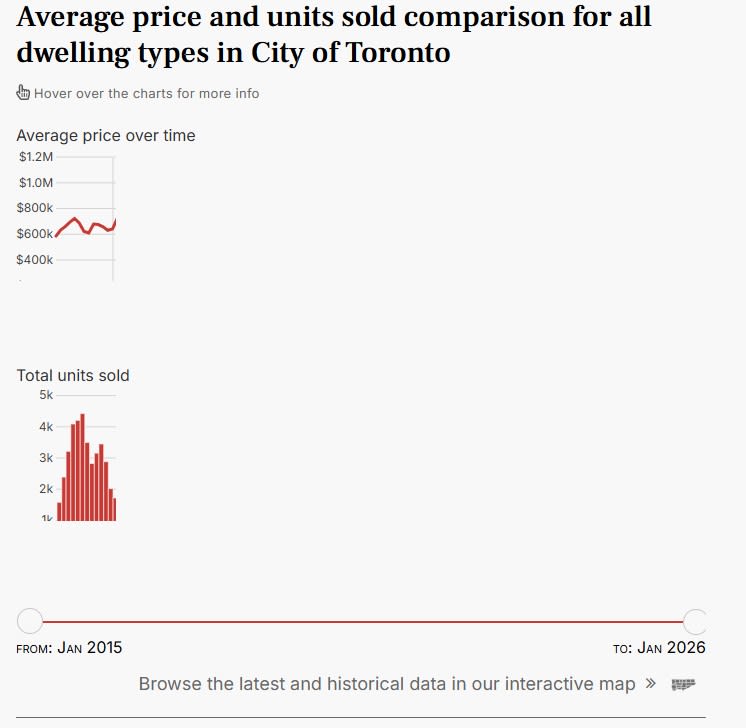

TRREB’s market outlook for the year closely resembles the dismal year in sales in 2025, which hit a 25-year low.

By Clarrie Feinstein| Business Reporter

Wed, Feb 04, 2026

Home prices in the Toronto-area have finally dropped below the $1 million mark — which hasn’t been seen in five years.

The average selling price of a GTA home in January was $973,000, down 6.5 per cent from the same time last year, according to the Toronto Regional Real Estate Board’s (TRREB) Wednesday morning report.

The last time the average price was this low was January 2021 at $966,700.

“The housing market reflects the tension many households are feeling as we look ahead to 2026. Affordability has improved, but uncertainty continues to weigh on long term decisions like homeownership,” TRREB president Daniel Steinfeld said in the report, which found sales took a nosedive with just over 3,000 transactions in January, down 19.3 per cent year over year.

“Greater economic clarity in the months ahead could restore confidence and help unlock demand that has been building for several years.”

The average sales price for all property types has dropped by 27 per cent since the February 2022 peak. Some economists say a 30-per-cent price drop is a housing crash.

TRREB’s market outlook, also released on Wednesday, isn’t painting a rosier picture as prices and sales are expected to remain relatively flat in 2026. However, they said improved affordability could bring in first-time homebuyers.

Experts say this cohort are generally older than previous generations, have savings and are ready to buy as their monthly rent is no longer significantly less than mortgage carrying costs. Instead, it will be “move up” buyers without urgency who will continue to wait on the sidelines.

Shawn Zigelstein, broker and leader of Team Zold, Royal LePage Signature Realty, said the current home price is a “sign of the times” as consumer confidence takes a hit.

“I think a lot of people are sitting on their hands and not jumping into the real estate market because they’ve got so many other things that they are concerned about and really want to make sure they get all their ducks in a row before they plan to buy real estate,” he said.

TRREB expects 2026 to closely resemble the dismal sales of 2025, according to the market outlook, which hit a 25-year low.

Ontario’s largest real estate association forecasts anywhere from 60,000 to 70,000 sales in 2026. Last year, there were 62,433 sales, the lowest sales volume since 2000, which had 60,783 sales.

“Market activity in the first half of the year is expected to resemble 2025 levels, as many households remain cautious about committing to long-term mortgage payments,” the report said.

Cailey Heaps, president of the Heaps Estrin Real Estate Team in Toronto, said TRREB’s sales forecast is an accurate prediction of where the market stands as Canada and U.S. relations continue to be rocky due to persistent trade threats.

“Things will continue to be slow going,” she said. “The unease that we’re seeing from geopolitics and the broader economy is still creating uncertainty for some.”

While sales could marginally rise, home prices will remain relatively flat, TRREB said.

The outlook report forecast prices to be between $1 million and $1.03 million this year.

An excess of supply continues to give buyers substantial choice and therefore, negotiating power, placing downward pressure on pricing, the report said.

“With the cost of borrowing flattening out, affordability gains in 2026 will largely be seen on the pricing front, as buyers continue to benefit from negotiating power,” TRREB chief information officer Jason Mercer said in the report.

“A boost in consumer confidence could see buyers move off the sidelines later this year, which could provide support for home prices as market conditions tighten up.”

A key driver for sales in 2026 are first-time homebuyers, the report said, as affordability edges closer.

It won’t be a young first-time buyer, as Zigelstein points out the average age of this cohort is closer to 40 years old.

“Those buyers have had a great opportunity to save during the beginning of their working career over the last 10 to 15 years; they’ve got that money saved up and now they’re ready to enter the market because they do see the opportunity there to jump to some product that maybe they couldn’t have afforded previously,” he said.

Heaps also noted that this cohort grew up hearing they weren’t able to afford a home in Toronto and now, the monthly cost of rent and a mortgage payment are inching closer together.

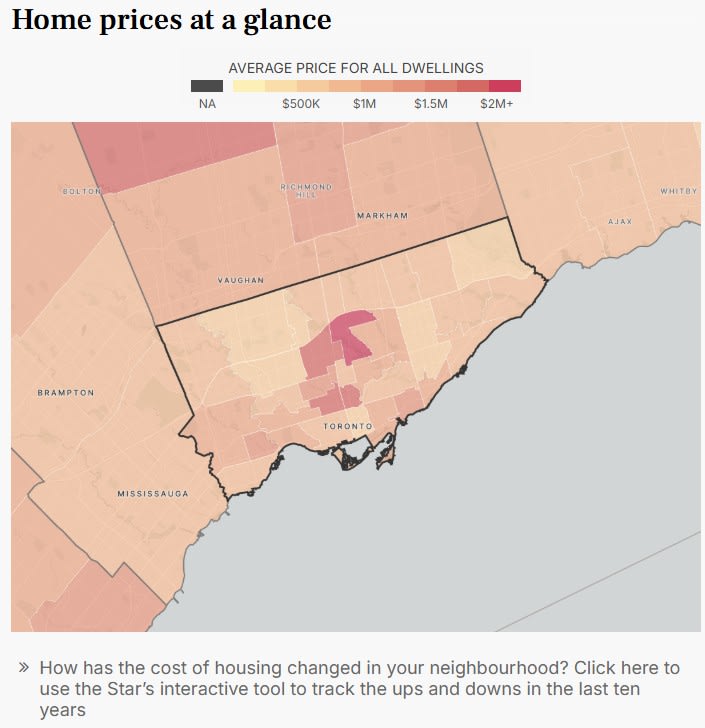

They’re saying, “‘Wait a minute, I’m paying three grand a month in rent, or four grand a month in rent, I can maybe now buy a smaller unit and enter the market,’” Heaps said, adding that a two-bedroom, two-bathroom condo is selling for around $400,000 in some parts of Toronto.

This year, discretionary moves or “move up” buyers looking to clinch a bigger home will be the ones who decide to wait because the move isn’t mandatory.

“They may not feel super comfortable with the economy and wait a few months to a year before deciding,” she said.