Canadian housing market update: Home sales activity is rising, but prices are not

Gradual recovery continues as buyers begin to make their way off the sidelines

By: Royal LePage

TORONTO, Oct 15, 2025

According to the Royal LePage House Price Survey and Market Forecast released today, the aggregate [1] price of a home in Canada recorded virtually no change in the third quarter of 2025, increasing just 0.1 per cent year over year to $816,500. However, on a quarter-over-quarter basis, the national aggregate home price posted a decline of 1.2 per cent, driven by depreciation in many major markets across the country over the summer.

“Canada’s housing market is shifting toward balance, as easing prices, rising listings and renewed rate cuts improve affordability across most regions,” said Phil Soper, president and CEO, Royal LePage. “For the first time in years, buyers – especially in previously supply-strapped markets – have real choice and negotiating power. With confidence returning and further rate reductions expected into early 2026, we anticipate noticeably stronger activity by the spring.”

Following a slower-than-usual start to the year, home sales picked up late in the spring and have consistently increased over the last five months, according to the Canadian Real Estate Association (CREA).[2]

“Affordability is improving and the economic backdrop remains remarkably stable, yet consumer confidence is lagging,” said Soper. “Many buyers remain hesitant – some worried about broader economic uncertainty, others waiting to see if prices dip a little further before stepping in.”

The Royal LePage National House Price Composite is compiled from proprietary property data nationally and regionally in 64 of the nation’s largest real estate markets. When broken out by housing type, the national median price of a single-family detached home increased 1.2 per cent year over year to $860,600, while the median price of a condominium decreased 1.6 per cent to $580,700. On a quarter-over-quarter basis, the median price of a single-family detached home and a condominium declined 1.1 and 1.9 per cent, respectively. Price data, which includes both resale and new build, is provided by RPS Real Property Solutions, a leading Canadian real estate valuation company.

Compared to the peak of pandemic pricing in the spring of 2022, national home prices have come down by approximately five per cent, driven by depreciation in the urban centres of Toronto and Vancouver, where prices are currently sitting more than 12 per cent below the peak. Meanwhile, home prices have continued to appreciate in Quebec, the Prairies and Atlantic Canada.

“Buyer sentiment is being influenced by a complex mix of economic and psychological factors,” said Soper. “Despite materially improved affordability in major cities, many Canadians – particularly younger ones – remain cautious amid high post-pandemic living costs, perceived job uncertainty, and general unease about our economic prospects. It’s understandable that some are waiting before making such a significant purchase.”

According to a recent Royal LePage survey, conducted by Burson, more than four in five Canadians (82%) who say they are actively working towards the purchase of their first residential property say they are planning to hold off for at least another year.[3]

Read full article HERE

REGIONAL SUMMARIES

Greater Toronto Area

The aggregate price of a home in the Greater Toronto Area (GTA) decreased 3.5 per cent year over year to $1,114,900 in the third quarter of 2025. On a quarterly basis, the aggregate price of a home in the GTA also declined 3.5 per cent.

Broken out by housing type, the median price of a single-family detached home decreased 1.2 per cent year over year to $1,403,800 in the third quarter of 2025, while the median price of a condominium decreased 7.4 per cent to $668,700 during the same period.

“The GTA housing market remains firmly in favour of buyers. Sales activity has been gradually increasing, however, this has not translated into price appreciation due to higher-than-normal levels of available inventory,” said Shawn Zigelstein, broker and leader of Team Zold, Royal LePage Your Community Realty. “Active listings are well up, with the influx of new listings consistently outpacing sales, providing prepared buyers with a significant advantage in both negotiating power and choice.”

Zigelstein also noted that properties are spending significantly more time on the market. “The average days on market is now edging towards two months – a stark contrast to the pandemic real estate frenzy, when properties were selling in just a few days. Sellers who price their homes too high are finding them languishing, as buyers remain cautious, selective and still highly price-sensitive.”

In the city of Toronto, the aggregate price of a home decreased 4.6 per cent year over year to $1,076,700 in the third quarter of 2025. During the same period, the median price of a single-family detached home decreased 7.4 per cent year over year to $1,548,700, while the median price of a condominium decreased 5.6 per cent to $644,700.

“Buyer confidence, while showing incremental improvement with clearer interest rate signals, is still restrained by a broader sense of unease about the job market and the stability of the economy overall. This lack of urgency is the defining characteristic of the current market – buyers are actively searching, but many appointments and showings are not yet converting into sales. With an unusual amount of housing stock available and affordability continuing to improve, very few people are in a hurry to buy.”

Looking ahead, Zigelstein expects this trend to continue through the remainder of the fall. He added, however, that policy reform will be necessary before activity inevitably picks up again.

“This is a rare moment of opportunity for buyers in Toronto, but the long-term health of the housing market requires special focus on increasing the right kind of housing supply – not just at the right price point, but also the right size. Development processes will need to be easier, cheaper and faster in the future.”

Royal LePage is forecasting that the aggregate price of a home in the Greater Toronto Area will decrease 3.0 per cent in the fourth quarter of 2025, compared to the same quarter last year. The previous forecast has been revised down to reflect current market conditions.

Read more HERE

Royal LePage House Price Survey Chart: rlp.ca/house-prices-Q3-2025

Royal LePage Forecast Chart: rlp.ca/market-forecast-Q3-2025

Forecast

“We expect the uptick in sales that began this summer to carry through the fall, setting the stage for a brisk 2026 spring market, provided consumer confidence continues to recover,” said Soper. “Prices are likely to tread water in the near term, as improved affordability and lower borrowing costs draw more buyers back to the table. Finally, the return-to-office trend should renew demand in urban cores, even as lower prices in suburban and rural communities continue to attract families – just not at the scale we saw during the pandemic.”

Third quarter highlights:

- In the third quarter of 2025, the national aggregate home price remained flat year over year; declined 1.2% over Q2.

- The Greater Montreal Area’s aggregate home price increased 4.9% year over year, while the greater Toronto and Vancouver markets recorded declines of 3.5% and 3.1%, respectively, in the third quarter.

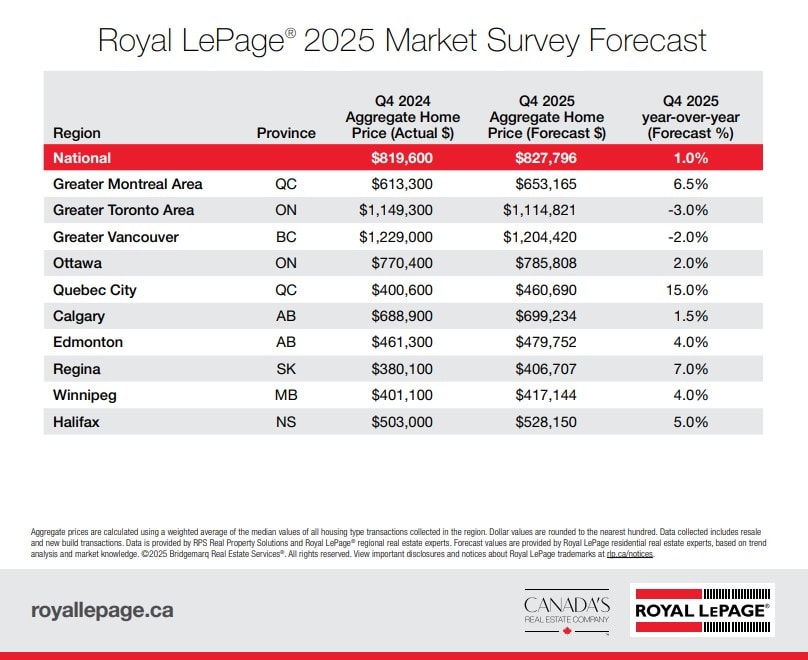

- National year-end forecast adjusted downward due to price declines in greater regions of Toronto and Vancouver, with the aggregate price of a home now expected to increase a modest 1.0% in Q4 2025 over the same quarter last year.

- Royal LePage® applauds federal government’s commitment to build more housing; warns that greater efforts are needed to materially boost supply long-term.