Rising inventory keeps home prices in check as recovery begins

By: Royal LePage

TORONTO, Jul 15, 2025

According to the Royal LePage House Price Survey and Market Forecast released today, the aggregate price of a home in Canada eased upwards modestly in the second quarter of 2025, increasing 0.3 per cent year over year to $826,400. On a quarter-over-quarter basis, the national aggregate home price decreased by 0.4 per cent.

The start of the spring market – typically one of the busiest times of year for home buying and selling – was noticeably subdued in several regions this year, namely in Toronto and Vancouver, two of the country’s largest and most expensive markets. Amid global political and economic uncertainty, many homebuyers continued to take a cautious, wait-and-see approach. The Bank of Canada also held back, maintaining its overnight lending rate at 2.75 per cent during its scheduled April and June announcements, citing the need to “gain more information about both the path forward for U.S. tariffs and their impacts. ”Sellers, on the other hand, continue to actively list their homes for sale despite lower than normal activity.

“Homebuyers approached the start of the 2025 spring market with hesitation, dampening what is typically the busiest season on the real estate calendar,” said Phil Soper, president and CEO of Royal LePage. “With trade disputes, a federal election, and international conflicts dominating headlines through the first half of the year, many prospective buyers chose to wait. Yet, market fundamentals remain sound; interest is strong while activity is subdued, reflecting the uncertainty weighing on consumer sentiment. Encouragingly, June’s robust employment report may help rebuild confidence and bring more buyers off the sidelines in the months ahead.”

Read full article HERE

REGIONAL SUMMARIES

Greater Toronto Area

The aggregate price of a home in the Greater Toronto Area (GTA) decreased 3.0 per cent year over year to $1,155,300 in the second quarter of 2025. On a quarterly basis, the aggregate price of a home in the GTA remained relatively flat, increasing 0.8 per cent.

Broken out by housing type, the median price of a single-family detached home decreased 1.2 per cent year over year to $1,448,700 in the second quarter of 2025, while the median price of a condominium decreased 5.6 per cent to $699,700 during the same period.

“The typical spring surge in activity failed to materialize this year, resulting in more of a blip than a boom in the Toronto housing market the last few months. That said, we’ve seen a notable increase in requests for showings in recent weeks, indicating that buyers are actively browsing, even if they’re still hesitant to commit,” said Shawn Zigelstein, broker and leader of Team Zold, Royal LePage Your Community Realty. “Many clients remain cautious, citing ongoing economic uncertainty as a reason to wait. However, a smaller group sees the current conditions as an opportunity to enter one of Canada’s most competitive housing markets while activity is subdued.”

In the city of Toronto, the aggregate price of a home decreased 5.2 per cent year over year to $1,151,600 in the second quarter of 2025. During the same period, the median price of a single-family detached home decreased 4.7 per cent year over year to $1,679,700, while the median price of a condominium decreased 5.0 per cent to $675,800.

According to the Toronto Regional Real Estate Board, home sales in June were down 2.4 per cent compared to the same period last year.[7] However, on a seasonally adjusted basis, sales rose in June compared to May 2025, indicating a modest month-over-month improvement in activity.

“Activity in Toronto’s condo market remains depressed, further weighed down by a steady stream of new construction completions that continue to add to existing supply. With rental demand softening due in part to less international students and newcomers entering the city, investor interest in condos has declined, and fewer are adding units to their portfolios,” noted Shawn Zigelstein. “One bright spot has emerged: larger condo units. These more spacious layouts are attracting first-time buyers who see them as a more attainable entry point into the market.

“We expect the market to remain sluggish in the months ahead, at least until consumer confidence shows meaningful improvement. Additional interest rate cuts are unlikely to significantly boost buyer activity, as many are already benefiting from substantially lower rates compared to last year. For sellers, the key will be strategically pricing their properties to attract interest, while managing expectations around offers, given current market conditions.”

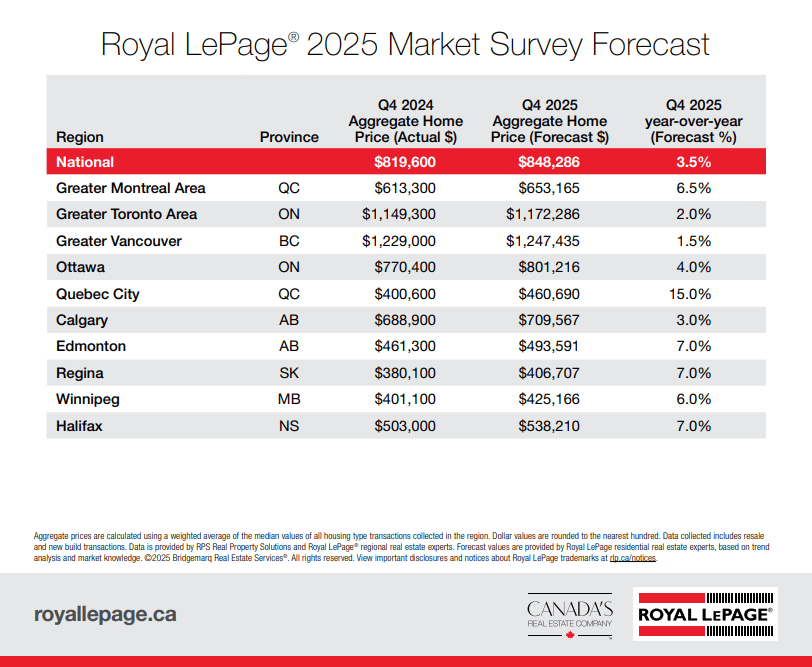

Royal LePage is forecasting that the aggregate price of a home in the Greater Toronto Area will increase 2.0 per cent in the fourth quarter of 2025, compared to the same quarter last year. The previous forecast has been revised down modestly to reflect current market conditions.

Read more HERE

Royal LePage House Price Survey Chart: rlp.ca/house-prices-Q2-2025

Royal LePage Forecast Chart: rlp.ca/market-forecast-Q2-2025

Forecast

“Given the backdrop of global economic uncertainty and cautious sentiment at home, we expect steady but uneven progress across regional markets this summer, rather than a broad-based rally. If optimism continues to build and Canadians feel more secure about the economy – and our ability to successfully manage the country’s relationship with the United States – we could see a more confident and active housing market emerge later this year,” concluded Soper.

Second quarter highlights:

- The national aggregate home price flatlined, rising a modest 0.3% year over year in Q2 2025, and declining 0.4% over Q1.

- Greater Montreal Area’s aggregate home price increased 3.5% year over year, while the greater Toronto and Vancouver markets recorded declines of 3.0% and 2.6%, respectively in the second quarter.

- 38 of the 64 cities in the report saw year-over-year prices rise or remain roughly flat, while 26 markets saw home prices decline – a majority of which are in the province of Ontario.

- For the fifth consecutive quarter, Quebec City leads the country in aggregate price appreciation, increasing 13.5% year over year in Q2.

- Royal LePage® lowers its national year-end forecast modestly, with prices now expected to increase 3.5% in Q4 2025 over the same quarter last year.